The likes of Uber and Lyft have made their mark with commuters, but these mobility giants have a long way to go before becoming the primary way for us to get around. Antenna Group examines the history and future of ridesharing strategies.

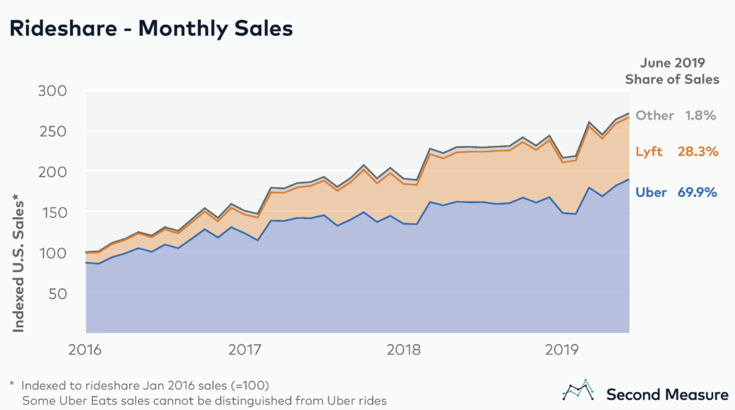

The mainstream of ridesharing platforms happened quickly. The now-defunct Sidecar first pioneered the concept of on-demand rideshare, launching with the support of many investors in 2011. By late 2015, the San Francisco-based group was overshadowed by more efficient and well-organized competitors. Today, two companies, Uber and Lyft, lead an industry full of smaller rivals with various tweaks to their business models and service offerings. Companies such as Via offer pooled rides that stop at designated areas for a flat fee. Others, like Gett, do away with surge pricing and pay drivers by the minute.

The journey of the entire industry is almost as multifaceted as the amount of competitors that currently thrive in the space. Culturally, it didn’t take long for consumers to accept our new mobility overlords. We readily order cars to shepherd party groups to the next destination, hail them to move groceries and have even used rides as alternative ambulances. These companies infiltrate pop culture, most recently in the form of the Dave Bautista/Kumail Nanjiani buddy popcorn flick, “Stuber,” where Grammy-nominated rappers masquerade as Chicagoan Lyft drivers for promotional material.

Despite our personal reliance on these apps, there are opposing groups stunting an even wider proliferation of ridesharing. New York and other major cities have fought back to curtail growth. Just a few months ago, Mayor Bill de Blasio pushed efforts to curb the amount of ridesharing cars in Manhattan. While the stated purpose was to reduce overall road congestion and improve driver wages, lobbying local taxicab operators suggest the effort is also intended to control competing business.

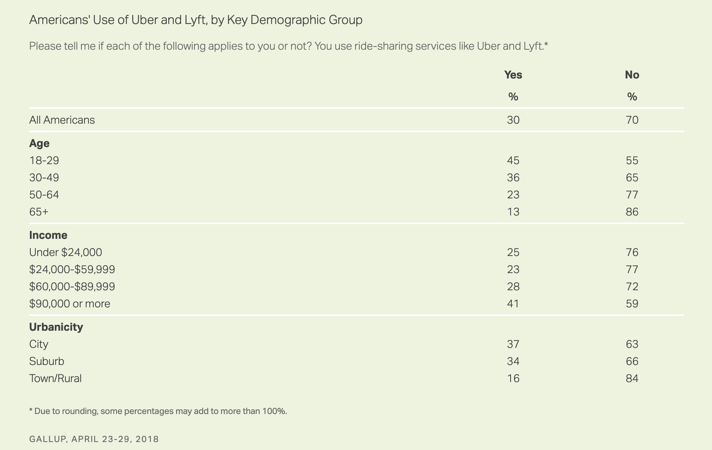

Indicated in a Gallup poll, disparities across class, age and location also limit the reach of many ridesharing companies. Thankfully, leaders in the industry are actively trying to overcome these political and societal bulwarks. Diversification is key for any business line, and these companies are incorporating new target markets and new modes of transportation into their platforms. By addressing passengers in unengaged communities and offering other forms of transport beyond cars, the likes of Uber and Lyft are future-proofing their services.

Connecting to alternative transit options

As these groups work to earn the favor of local municipalities, ridesharing apps can continue to grow their customer base by incorporating multimodal options. Meaning, offering access to different forms of transportation without strictly focusing on shared cars. This is particularly important across the world as urban populations increase.

Flexible and lightweight options like bicycle-sharing are an easy solution to this growing problem. In cities such as Los Angeles, commuters can already rent pedal-assisted JUMP electric bikes through the Uber app, and electric scooters will soon join its fleet of options. Lyft recently unveiled a setting that shows nearby public transit stops, addressing the dreaded last mile problem facing commuters. Not everyone lives near transit routes, and ridesharing can fulfill gaps in service. This is particularly true for commuters from low-income areas.

Striving for equitable transportation for rural and low-income communities

Ridesharing services are often viewed as the poster child of class discrimination. Contrary to public transit and their stigma of prioritizing poorer commuters, ridesharing offers a more pampered approach for wealthier passengers. Data supports the notion, as the percentage of rideshare commuters jumps with higher wages. It doesn’t help that some services are explicitly targeting the elite. The new Uber Black feature mirrors private car services with exclusive phone support and an option to keep drivers silent — all at a premium. The even more exclusive Uber Elevate offers helicopter rides from Manhattan to JFK starting at $200. Other aviation startups, like BLADE, connect passengers to flights going to areas like the Hamptons for $795, more than two times the price of a normal car ride.

With that said, there are other demographics to focus on, namely those in low-income or rural neighborhoods. Those areas would serve well with an expanded scope of ridesharing options. Often away from public transit stops, these locations could benefit from subsidized fares backed by tax-payers. Pinellas County in Florida bolsters its bus service with Uber discounts to great success. Other models that are currently in play are subscription services marking down costs or even combining different transportation types. Lyft’s All-Access Plan provides savings for repeat travelers.

Ridesharing apps should expand their services to attract and more seamlessly fit the needs of elderly or disabled passengers. Again looking at the Gallup poll, while those passengers are less likely to use ridesharing options, participation figures are only expected to increase as senior-friendly apps join the market. GoGoGrandparent and Onwards specifically allow older adults to access on-demand rides, with a bevy of tracking and safety features. While not as thorough, the current Uber app allows users to request rides for family members.

There is an app for that

Ridesharing is indeed here to stay. As ridesharing continues to grow in popularity, companies must differentiate or adapt to meet consumer needs in order to sustain growth. Services will have to adapt to serve broader demographics and offer new transportation types for an increasingly urban landscape. By focusing on the needs of passengers, these on-demand services can anticipate challenges and target available markets. Whether by car, bicycle or plane, the commuter of the future will require more options.

Image Credit: Elvert Barnes / Flickr